RESident Retention, MeaninGful Value

Rent Reporting for All

We put the ‘S’ in ESG or Environmental, Social, and Governance initiatives. RentPlus is our unique solution that allows renters to build and improve their credit by ensuring timely rent and utility payments. We’ve eliminated the need for credit checks or loans, making it a premier feature for property management companies (PMCs) focused on retaining residents.

Multifamily Credit Building Programs for the Win-Win-Win

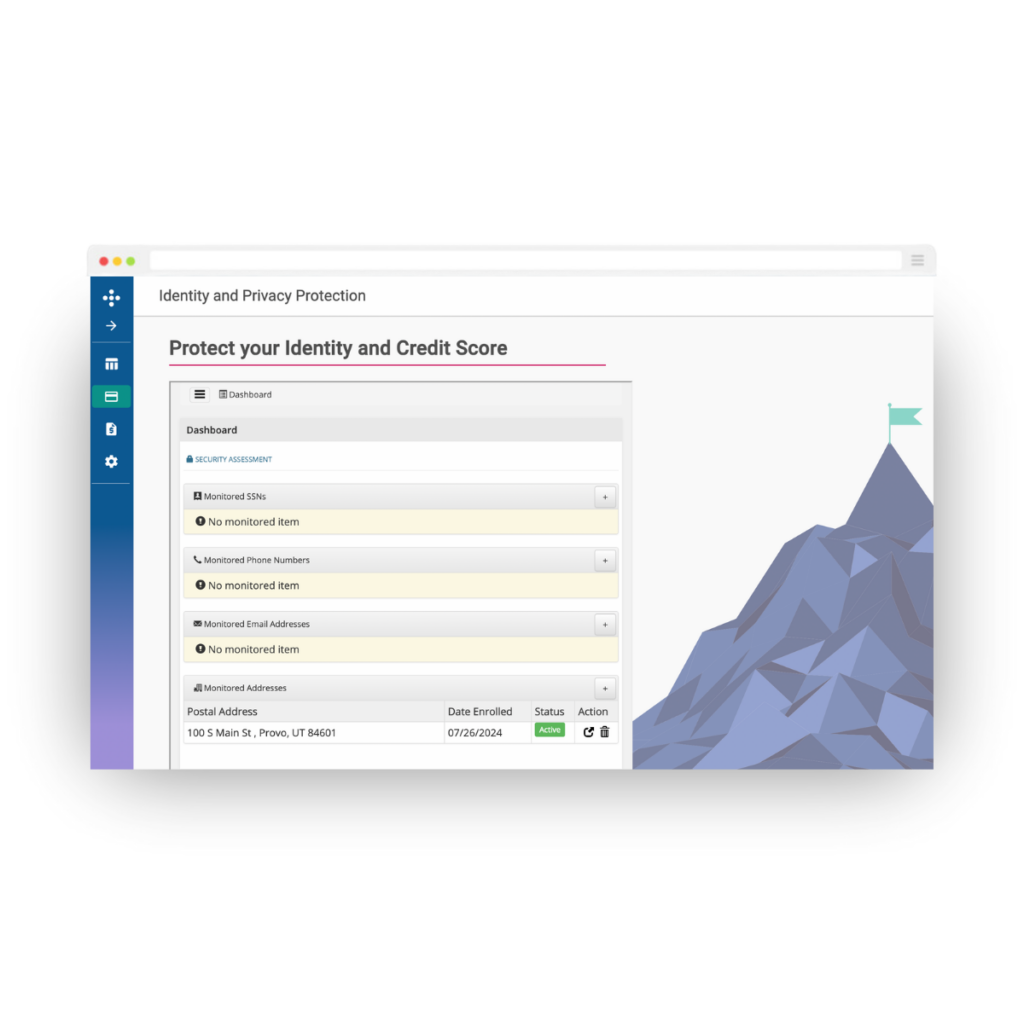

RentPlus is a unique “win-win” social initiative with features that include credit-building with RentPlus, ID theft, and fraud protection services, budgeting tools, and a free credit score tracker. For PMCs, RentPlus promises higher tenant retention, fewer late rent payments, and new revenue streams.

What value will RentPlus® bring for your community?

RentPlus®, a credit-building program for multifamily properties, has been transformative for communities that provide this rent reporting service. We would like to demonstrate how your residents can develop financial independence by paying their monthly rent and utility bills. Leave your information below!

For Residents

Support your residents with RentPlus. Amidst financial challenges, RentPlus is a beacon for underserved communities. We allow up to 24 months of backdated, paid utility bills to boost credit scores. With minimal requirements and no credit checks or loans, residents benefit from rent reporting, and RentPlus Money for budgeting. A genuine WIN for residents!

For Communities

The RentPlus program is creating a buzz among residents! With our platform, the dream of rental credit reporting becomes a reality. Rental payments are now reported to all three major credit bureaus – Equifax, TransUnion, and Experian. This initiative empowers community leasing agents and local managers to assist their residents in achieving financial success. By encouraging punctual rental payments, they’re positively transforming their residents’ lives. A WIN for communities!

For Property Management Companies

In these uncertain times, RentPlus offers PMCs new revenue opportunities. The potential for an annual income of up to $10K MRR is groundbreaking. Use our revenue calculator to estimate your earnings. A WIN for PMCs!

We Put the ‘S’ in ESG –

Experience the profound influence of RentPlus. Our initiative appeals to socially conscious investors and aligns with the ESG trend in CRE. RentPlus provides lasting value to residents, helping them qualify for loans through consistent rent payments and offering financial tools for a prosperous future.

RentPlus FAQ

RentPlus is a pioneering credit-building program for renters. It empowers them to fortify their credit through punctual rental and utility payments without the constraints of credit checks or loans. The program encompasses features like credit-building accounts with FinStrong, RentPlus Money tools for residents, and an upcoming free credit score tracker.

RentPlus enhances communities and PMCs by increasing tenant retention, reducing late rent payments, and introducing new revenue opportunities. RentPlus makes rental credit reporting a reality, as payments are reported to all three credit bureaus.

RentPlus supports residents in achieving financial independence. The program also provides a 24-month retroactive credit for consistent utility bill payments, leading to a rapid credit score boost. The combination of rent reporting, and RentPlus Money offers a powerful financial toolkit.

RentPlus epitomizes the ‘S’ in ESG, symbolizing a socially responsible venture that aligns with the ESG trend in CRE. RentPlus adds value to residents, assisting them with loan qualifications and equipping them with financial tools for a brighter future.

An Amenity that Sets You Apart

Marketing

- RentPlus is a true differentiator and community selling point

- Offers a unique amenity to stand apart from your competitors

Build Revenue While Making a Difference

Leasing

- Encourages credit-conscious renters

- Reduces delinquent payments

- Provides ancillary revenue to the property management company

Leave a Lasting Positive Impact

Retention

- Helps residents build and maintain credit

- Automatically categorizes purchases to set and view a budget, and track savings goals

- Drives financially responsible behaviors with text alerts and credit tips

- Can help residents qualify for major purchases like buying a car, paying for college, etc.

- Includes fraud protection policy (up to $1 million coverage)

Start your Journey with Rent Dynamics

Schedule a demo with one of our product experts today.

Start Improving Your Credit Score Today

Learn more about how rental payment reporting can help you achieve your financial goals.